is there a death tax in texas

Is there a death tax in texas. And if the estate.

Texas Death Penalty Facts Tcadp

Call or Text 817 841-9906.

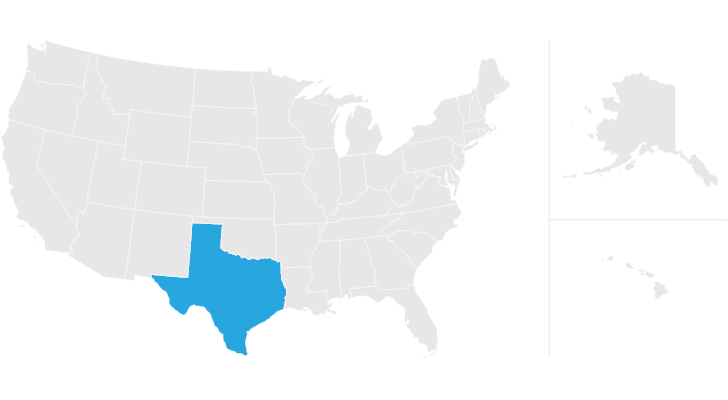

. Death Taxes in Texas. The federal government and some state governments impose estate taxes on decedents estates. The affidavit must be provided to the county tax assessor-collector along with Form.

Youll have to pay taxes twice through estate tax once when you earn the money and again when you pass along your estate. No not every state imposes a death tax. There is a Federal estate tax that applies to estates worth more than 117 million.

The absence of the gift and death taxes in Texas leaves the states residents a place for legal maneuvering to reduce their estates. You can work with Vital Statistics to order certified copies of or make changes to death records. Receipt of an unencumbered inherited motor vehicle as specified by a deceased persons will or through Texas Department of Motor Vehicles TxDMV Form VTR-262 Affidavit of Heirship for a Motor Vehicle PDFIf there is an executorexecutrix the executorexecutrix should sign.

There are two main types of death taxes in the united states. The federal estate tax is a tax on your right to transfer property at your death. Vital Statistics maintains death records for the state of Texas.

Vital Statistics issues certified copies of death certificates or death verifications. It consists of an accounting of everything you own or have certain interests in at the date of death. While there is no state inheritance tax in Texas your estate may be subject to the federal estate tax.

It is a transfer tax imposed on the wealthy at death. Being a beneficiary of an estate means carrying the responsibility of paying inheritance tax in certain states but Texas repealed state inheritance tax in 2015. Cons of death tax.

This means that an estate might be required to pay both federal and state estate taxes and the heirs. If you die with a gross estate under 114 million in 2019 no estate tax is due. A final income tax return will be required if the decedents income exceeds the filing thresholds established under the.

This means that the state does not have an inheritance or an. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15 million which represents the tax due on a Connecticut estate of approximately 129 million. If your gross estate is over 114 million you pay a tax on.

Estate taxes and inheritance taxes. There would be no tax due on the first spouses death. Prior to September 15 2015 the tax was tied to the federal state death tax credit.

But in TX this credit is no longer included on the federal estate-tax return. Federal exemption for deaths on or after January 1 2023. The state sales tax rate in Texas is 625 percent.

Is there a death tax in texas Thursday June 9 2022 Edit. Inherited Motor Vehicles Taxable as Gifts. This means that if a person passes away on June 1 2009 that persons final income tax return will cover only the period from January 1 2009 until June 1 2009.

When someone dies their estate goes through a legal process known as probate. Because the state is free of inheritance tax heirs to an inheritance wont be taxed on it. However there is still a federal estate tax that applies to all property that exceeds the 1206 exemption bar if a person has deceased after January 1 2022.

Each of the following transactions is subject to the 10 gift tax. These taxes are levied on the beneficiary that receives the property in the deceaseds will. Ad Fisher Investments has 40 years of helping thousands of investors and their families.

Britain S Biggest Uk Solar Farm Unveiled Huge 224 Acre Site Comprising 135 000 Panels Could Be Built On Cornish Farmland Solar Farm Renewable Energy Wind Wind Farm Pin On Texas Tapa. The death tax is only hitting the wealthiest Americans. Understand the different types of trusts and what that means for your investments.

Texas does not have an estate tax either. And some states levy inheritance taxes on people. The fair market value of these items is used not.

Taxes imposed by the federal andor state government on someones estate upon their death. The Texas estate tax system is a pick-up tax which means that TX picks up the credit for state death taxes on the federal estate tax return. Theres no estate tax in Texas either although estates valued at more than 1206 million can be taxed at the federal level as of 2022.

The siblings who inherit will then pay a 11-16 tax rate. The vast majority of us more than 99 wont stand to ever pay an estate tax. A death record is a vital document that records a persons death.

Does every state impose a death tax. The estate tax sometimes referred to as the death tax is a tax levied on the estate of a recently deceased person before the money passes on to their heirs. A persons death terminates his or her taxable year.

Taxes levied at death based on the value of property left behind. Six additional states also levy an inheritance tax. Only 12 states plus the District of Columbia impose an estate tax.

Live Call Answering 247. Pin On Family Law UT ST 59-11-102.

Texas Death Penalty Facts Tcadp

Texas Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is The Probate Process In Texas A Step By Step Guide

Texas Death Penalty Facts Tcadp

Texas Estate Tax Everything You Need To Know Smartasset

Where Not To Die In 2022 The Greediest Death Tax States

Texas Inheritance Laws What You Should Know Smartasset

Texas Death Penalty Facts Tcadp

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Texas Death Penalty Facts Tcadp